Does Ford F150 Qualify For Section 179

For most small businesses the entire cost of qualifying equipment can be written-off on the 2018 tax return for up to 1000000. And a bed length of at least six feet ie Ford F-150F-250F-350 qualify for the maximum first-year depreciation deduction.

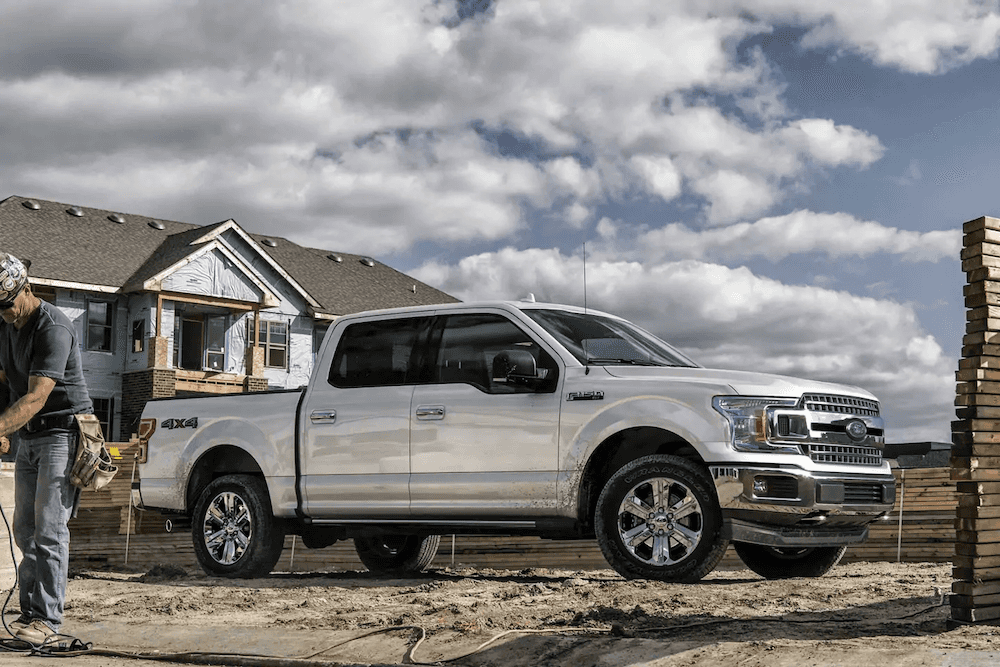

2019 Ford F 150 Ford Dealer In Norwood Ma Jack Madden Ford

100 Tax deduction for qualifying self-employed and business owners on new Ford vehicles Section 179 is the current IRS tax code that allows businesses to buy qualifying Ford vehicles and deduct up to the full purchase price including any amount financed from gross taxable income if.

Does ford f150 qualify for section 179. IRS Section 179 lets you write off up to 1 MILLION of qualifying new equipment in the year it is put into service and that includes a Ford vehicle used for business. Ford Vehicles that Qualify for Section 179 Deduction. Doing your own taxes you could claim its just a qualifying F150 and take your chances but.

Deduct Up To 100 of Purchase Price for Eligible Ford Vehicles Section 179 of the IRS tax code allows businesses to write off the entire purchase price of qualifying equipment for the current tax year. Just like with vans the amount that can be deducted in the first year comes down to the weight of the vehicle. Section 179 is the current IRS tax code that allows you to buy qualifying Ford vehicles and deduct up to the full purchase price including any amount financed from your gross taxable income if purchased before December 31 2020.

SUVs That Qualify For The Section 179 Deduction. This limitation on sport utility vehicles does not impact larger commercial vehicles commuter vans or buses. Section 179 is the current IRS tax code that allows you to buy qualifying Ford vehicles and deduct up to the full purchase price including any amount financed from your gross taxable income if purchased before December 31 2020.

That means that if you buy a piece of qualifying equipment and products you may be able to write off up to the FULL PURCHASE PRICE from your gross taxable income this. Section 179 of the IRS tax code allows many business to deduct up to the FULL PURCHASE PRICE of qualifying equipment purchased or financed in the 2010 tax year. Trucks with a GVWR greater than 6000 lbs.

Bed Explorer Expedition qualify for a maximum first-year depreciation deduction of up to the first 25000 of the full purchase price plus 60 depreciation of. Expeditions could also qualify and F250s should certainly qualify subject to the rules about business use. Some Ford SUVs qualify for a 25000 deduction in the first year while others only qualify for an 11160 deduction in year one.

These new Ford vehicles qualify for the maximum first-year depreciation deduction of up to the full purchase price. But because its too short you technically are limited to the 25K cap. Let Gresham Ford help your bottom line with the IRS section 179.

Up to 25000 of the cost of vehicles rated between 6000 lbs GVWR and 14000 lbs GVWR can be deducted using a section 179 deduction. Ie Ford F-150 SuperCrew 5½ ft. That means that if you buy a piece of qualifying equipment and products you may be able to write off up to the FULL PURCHASE PRICE from your gross taxable income this.

This is true for the full five-year depreciation period that applies to vehicles. Section 179 is the current IRS tax code that allows you to buy qualifying Ford vehicles and deduct up to the full purchase price including any amount financed from your gross taxable income if purchased before December 31st 2017. The equipment vehicle s andor software must be used for business purposes more than 50 of the time to qualify for the Section 179 Deduction.

Section 179 is the current IRS tax code that allows you to buy qualifying Ford vehicles and deduct up to the full purchase price including any amount financed from your gross taxable income if purchased before December 31 2019. If it were 6 youd qualify for the full deduction under 179. IRS Section 179 depreciation deduction.

To qualify for bonus depreciation or Section 179 you must use your vehicles for business more than 50 percent of the time. If youre a small business owner and you bought a Ford vehicle during 2018 you may be eligible for a tax refund. Explorer 2WD and 4WD Expedition 2WD and 4WD F-150 and larger 2WD and 4WD.

If your use dips below 50 percent during any of that five-year period youll have to repay your bonus depreciation deduction. SUVs including trucks with a bed length of fewer than six feet and a GVWR greater than 6000 lbs. Simply multiply the cost of the equipment vehicle s andor software by the percentage of business-use to arrive at the monetary amount eligible for Section 179.

2021 Ford F 150 Xl Rwd Truck For Sale In Denton Tx Mkd90374

Section 179 Tax Incentive Eligible Vehicles At Eide Ford Lincoln

Learn More About The 2020 Ford F 150 Truck Doug Henry Ford Of Ayden

2020 Ford F 150 In Norwood Ma Trucks For Sale Jack Madden Ford

2019 Ford F 150 Bed Size Cab Options Badger Truck Auto Group

2019 Ford F 150 Info And Specs Columbine Ford

2021 Ford F 150 Lease Deal 342 Mo For 36 Months Imlay City Ford

Ford F 150 Lease Specials Finance Deals Wall Township Nj

New 2021 Ford F 150 Xl Super Cab In Port Orchard Mkd70086 Port Orchard Ford

2021 Ford F 150 For Sale Hurlock Md Preston Ford

2021 Ford F 150 Xlt In Miami Fl Miami Ford F 150 Metro Ford

2021 Ford F 150 Incentives Specials Offers In Bend Or

Ford F150 Truck Full Size Pickup Truck Koonsford Com

2019 Ford F 150 Bed Size Cab Options Badger Truck Auto Group

Available 2017 Ford F 150 Bed Lengths

2020 Ford F 150 Tallahassee Fl Tallahassee Ford

2019 Ford F 150 Ford Dealer In Norwood Ma Jack Madden Ford

2021 Ford F 150 Tremor Chastang Ford Blog

Post a Comment for "Does Ford F150 Qualify For Section 179"